Every few years, major media outlets publish articles on how investing in LEGO is better than investing in the stock market or gold. In a recent article from The Guardian (source), the value of LEGO has been rising by 11% annually which is a better rate of return than many other common investments. As someone who invests both in stocks and LEGO, I believe that investing in LEGO is very different from investing in stocks or other financial instruments. Investing in LEGO is active investing while investing in stocks is passive investing. What does this mean? I will explain it more in detail below.

When looking at rate of returns for specific LEGO themes that investors like (i.e. Star Wars, Creator Experts, Speed Champions), average annualized return for LEGO sets were about 22% within 5 years of retirement and about 18% within 10 years of retirement. For stocks (using S&P 500 data), an average return of 15% for the last 5 years and 14% for the last 10 years can be seen. These numbers do not account for inflation, but you get the general idea of what the rate of returns can be like for investing in LEGO vs stocks.

With these numbers in mind, I will discuss differences between investing in LEGO in comparison to stocks. Also, I will take a deeper dive into the rate of return by periods and themes. Lastly, as with any other investments, you should be aware of few, unique risk factors when it comes to investing in LEGO.

ACTIVE VS PASSIVE INVESTMENT

As I mentioned in the beginning of the article, LEGO investing is different in the sense that it is a lot more hands-on type of investing than stocks. You will need to know which sets to buy, where and when to buy them and how you can sell them for profit. Unlike stock investing, there isn’t a LEGO trading brokerage firm to buy and sell your investments. Not yet at least. You will need to work as an investor and a broker to actively find ways to buy the right sets and find ways to sell them when it’s time to realize your investment.

This means that you need to continuously monitor retail stores to find deals through various sales, cashback offers, and creative ways to reduce your cost basis. You also need to store your investment/inventory in a climate and light controlled setting. This will allow you to keep your new sets in great shape to reduce shelf wear. Also, some people will have limited space in closets and storage rooms. Therefore, having large quantities may require renting a separate storage facility. Lastly, you will need to sell your LEGO sets through various channels like eBay, Amazon, and Local Facebook Market places. In order for you to sell LEGO sets online, you will need to list your products, set prices, fulfill orders, and handle customer care. Most platforms require some legalities as well regarding opening an online store front that you will need to be compliant with.

LONG TERM VS SHORT TERM

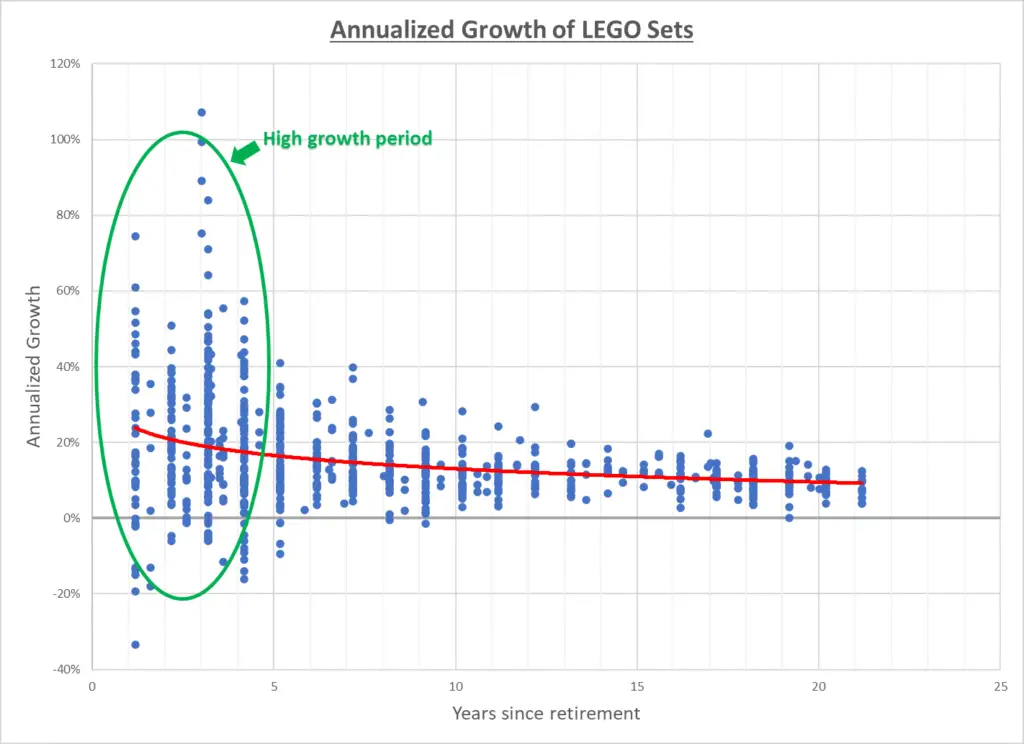

Let’s take a deeper look into the rate of returns for LEGO investing. While overall returns of investing in LEGO may be higher than stocks in some cases, LEGO investing should be looked as a short term investment rather than long term investment. There are sets like the UCS Millennium Falcon where the value increases consistently long term. The graph below shows that on average, most of growth happens within 5 years from the retirement date. The red trend line show that the growth rate will continue to go down as sets move further away from the retirement date. Therefore, holding the sets and knowing the right time to sell them within their retirement phase is incredibly crucial.

I have heard people say that ‘I will buy X set and hold it for next 20 years to help pay for the kid’s college tuition’, but is that a smart investment move? With the above graph, holding a set for longer than 5 years may not be the best use of your money as the value will only grow so much with the passing of years. You are also running into potential risk of re-release (i.e. UCS Millennium Falcon) where the value of an investment can have significant impact. Most successful LEGO investors will set realistic price target to sell within 2-5 years and move on to next set to purchase units for. Additionally, in the U.S., the profit one makes, regardless of how long you hold the sets, does not have any advantage of capital gains tax such as what one may see with stocks.

If you do intend to hold sets for longer than 5 years, I’ve done some comparison (see table below) between various sets to see which Themes can potentially get you the most returns in longer term. Results show that the best longer term investment themes are Architecture, Creator Expert, and Star Wars UCS at around 13-17% after 10 years. Also with this table, you can see a significant drop in the annualized growth rate after 5 years of retirement date as well.

RISK FACTORS

As with any other investments, there are risk factors associated with LEGO investment. These risks are mostly unique for investing in LEGO and different from investing in stocks and are truly worth considering.

Supply is not visible to regular investors. Unlike the stock market, there is no governing rule or public information for the investors (i.e. number of sets produced during their shelf life or plans for re-release). Therefore, the investors do not have visibility to the actual supply of LEGO sets. The risk for LEGO investing is that the supply is solely dependent on one party and that is The LEGO Group (TLG). TLG can decide to mass produce certain sets, extend the shelf life or re-release similar or slightly different versions. And this will definitely increase the supply of the LEGO sets and lower the market price.

Demand can also be influenced by the pop culture. As some LEGO sets are licensed products, the success of movies, shows, or video games can determine the demand in positive and negative ways. And these successes/failures is something the investors cannot predict and must be mindful of pop culture in general. As an example, the second release of Wonder Woman (WW84) movie was not a good movie. And the Wonder Woman SDCC set (77906) lost most of its value due to the lack of popularity of the movie.

Liquidity. Stocks can be sold and can make cash funds available fairly quickly. However, for LEGO investing, to capitalize on your profit, you will need to list the item, wait for it to sell, pack and ship and wait few days for money to go into your bank account. Also, if you have large quantities, you won’t be getting your money all at once, but as they are sold.

Final Thoughts

Although this article is mostly written from a more cautionary side, LEGO investing can be a lucrative addition to your investing portfolio if done right. Just like with any other sort of investing, knowledge is essential. Margins can be quite healthy and once you understand the basic concepts, it can be quite simple. If this sounds like it may be of interest to you, make sure you start doing your research prior to being your investments. If you enjoyed this article and wish to learn more about LEGO sets in general, check out one of our roundup articles such as Every LEGO Western Set Ever Released for more!