Let’s talk about a topic that gets a ton of confusion for new resellers in the LEGO investing world and all other reselling and e-commerce niches. This stuff really is important to try to get a grasp of early in your reselling career. If you don’t know the difference between ROI and profit margin, this is for you.

Don’t beat yourself up if you’re a seasoned reseller and you also mix these concepts up – it’s extremely common. I’ve seen a good number of experienced resellers talk about margin and ROI interchangeably as if they are the same thing. They’re not! So that’s why I’m writing – hopefully you find it useful when analyzing the success of your business.

Before we begin, I should point out that both ROI and profit margin do not factor in the time-value of money. As LEGO investors, we do need to think about how long we hold a set for in order to achieve our results. IRR (Internal rate of return) or CAGR (Compounded Annual Growth Rate) are common ways to do that, but let’s first take it to the basics and leave out the hold-time from our calculations.

ROI and profit margin are the baseline you need to understand to be a successful e-commerce business owner.

Let’s kick off with ROI.

Return on Investment (ROI)

Return on investment tells us how much money we made in relation to how much money we spent to get the sale. This is mostly shown as a percentage, but people often also talk about it in dollar terms.

When you hear somebody say that they made 8% in the stock market last year, this is what they are talking about. They made 8% on the money that they invested, so if the amount they invested was $1000, they would now have $1080. This concept of figuring out how much of a “return” we got on your investment also applies to any other type of investing as the most common way of analyzing success. It is used interchangeably with other acronyms or abbreviations, such as IRR (internal rate of return) which is most often heard in real estate discussions. But in our situation as resellers, ROI is also applicable.

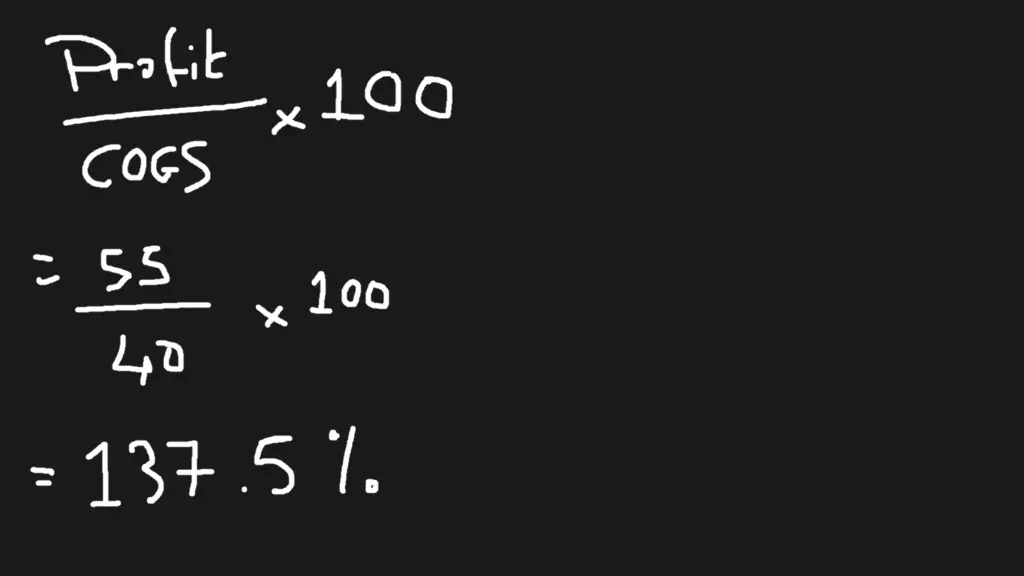

Let’s look at an example ROI calculation for the sale of a LEGO set on Amazon.

Cost of Goods: $40

Sale Price: $120

Amazon Fees (Incl. Shipping): $25

Gross Profit: $55

This is calculated as follows:

Pre-tax ROI for this book would be 137.5%.

Note that ROI shows the amount you earn AFTER you get your money back. So in the above example where we spent $40 and then earned $55 in profit – we also received our $40 back. So the total payout if this was an Amazon sale would have been $95. $55 of that is profit, so it is 137.5% ROI.

ROI is extremely useful because it allows us to figure out how quickly we can multiply our money. 100% ROI is doubling your money, for example. 50% ROI is earning half the amount you invested back in profit. If we can earn 100% ROI each year on every dollar we invest into our business, then we can calculate or project how fast the business will compound and grow over time.

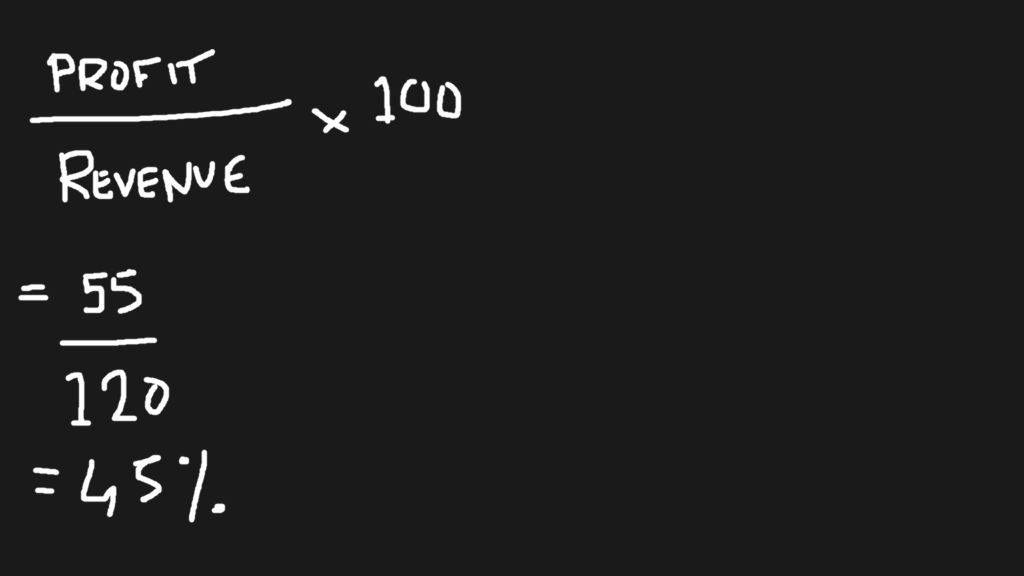

Profit Margin

Profit Margin is perhaps more commonly used in commerce when analyzing success metrics, but it is of equal importance in my opinion. Margin tells us how much of the total revenue earned was profit. In other words – what percentage of the sale was my profit vs what percentage was our costs. Or put another way – how much profit did we make for each dollar of revenue.

Margin is extremely useful in figuring out whether we are paying too much to achieve the profit that we are getting back. For example, if you run some calculations for the year and see that we had a profit margin of 10%, that means that for every $100 in sales that you had, you only made $10 in profit. If your profit margin was 40%, then you made $40 for every $100 of sales. Scaling that up – if you sold $150,000 of used books on Amazon with a profit margin of 40%, then your gross profit is $60,000.

Using the same sale of a LEGO set as the previous example, margin is calculated as follows:

Since profit margin tells us a lot about the costs of doing business, we can see it vary hugely from one industry to the next. Software sales, for example, can have incredibly high profit margins because there are low inventory fees. Software does not have the same costs associated with inventory storage, purchasing goods, damaged inventory and many other costs that comes with selling physical goods.

Which should we use?

Both! Use profit margin to analyze your costs, and figure out the underlying profit from your revenue numbers. Use ROI to analyze your investments, and determine whether the capital that your business is allocating to its various activities is making enough of a return for it to make sense over time.

Hopefully this has shed some light on how to approach this age old riddle of ROI vs Profit Margin! If you want more crucial areas to learn about investing and investing mindset, check out our post about 10 lessons from Warren Buffett that we can apply to our LEGO investing businesses.

If you want more strategies for investing and reselling, make sure to check us out on YouTube, where we give tons of more experience and strategies for LEGO reselling and investing. Also, we have a free Facebook group – join if you would like to learn from like-minded LEGO investors.

Do you use ROI or Margin more often when analyzing the success of your business? Let us know in the comments below!